27+ mortgage down payment gift

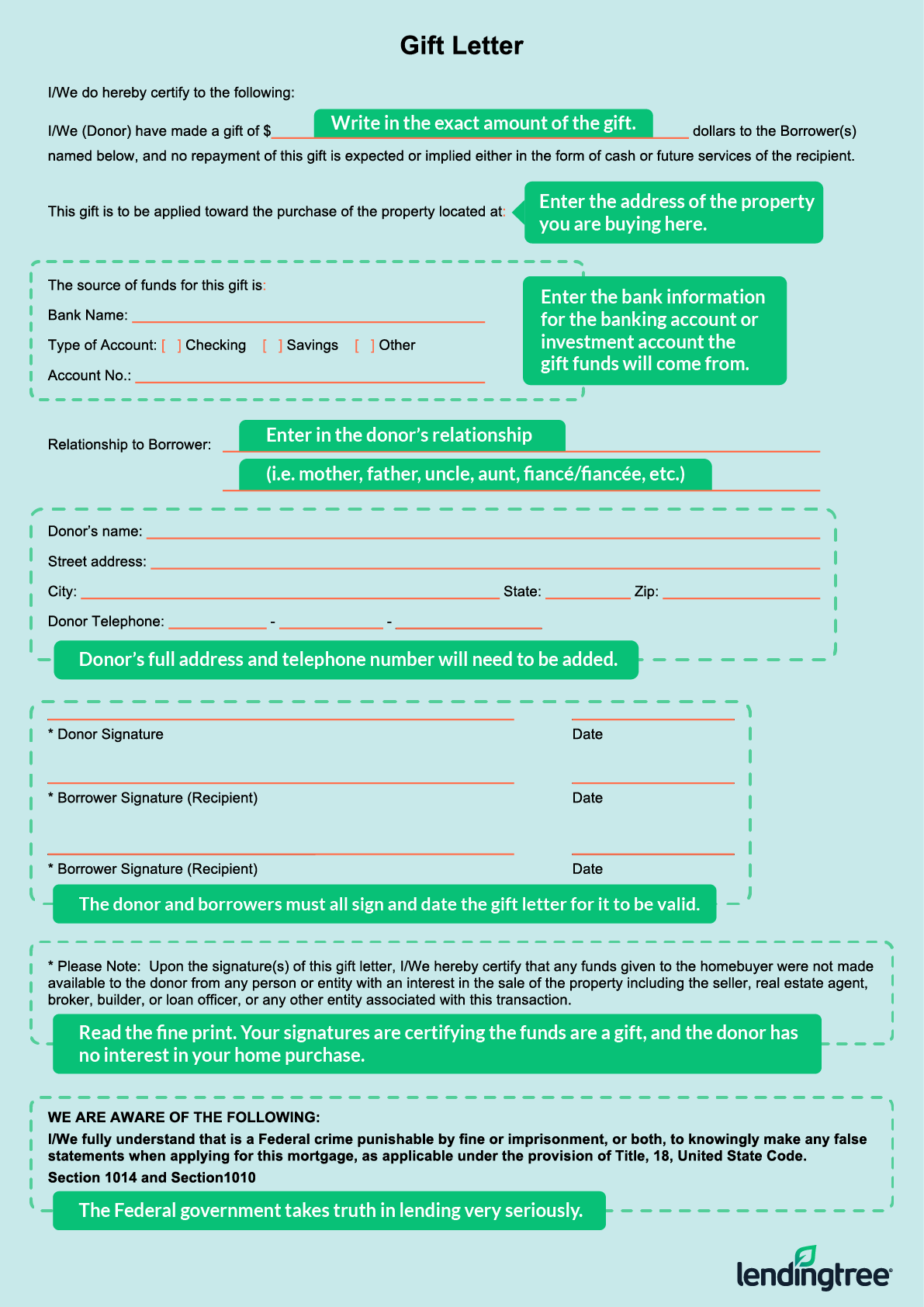

Beyond that amount the funds must be reported on the donors gift tax return. Its the affidavit signed by both the donors and borrowers stating they have followed the rules.

How To Complete A Gift Letter For A Mortgage Lendingtree

Web Maximum down payment gifts.

. Web CrossCountry Mortgage LLC 2160 Superior Avenue Cleveland OH 44114. The more money you have available for a down payment on your home the less youll have to borrow. And if your credit score is below 580 a minimum of 10 for a down payment is needed.

Web For parents making a down payment gift represents one of many ways to transfer wealth often with fewer tax implications. Compared to a 30-year fixed mortgage a 15-year fixed mortgage with. Tel Phone 877 773-1226 Corporate Customer Support.

Web The IRS currently gives people a lifetime gift exemption of up to 114 million which applies to any gifts you make over the course of your lifetime. Heres an example of how families can amass a bigger gift under that regulation. In turn parents can collectively give up to 32000 per child without needing to report those funds to the IRS.

Web When borrowers accept and apply gift funds for a mortgage down payment mortgage gift letter must be included in the loan file. Tel Phone 877 351-3400. This means you can reduce the interest paid and lower your total mortgage costs.

For your donor however it may not be so simple. All of your money may come from a gift if you have a down payment of at least 20 and at least 5 of your down payment needs to come from your own funds if you have a down payment of less than 20. Similarly the gift money cannot come from a payday loan or credit card.

If putting 20 or more down on an FHA loan the down payment can come. The gift tax exclusion limit for single filers is 16000. Web Mortgage Down Payment Gift Rules Before you accept a gift or ask friends or family members for help with your down payment or closing costs talk with your lender about what your loan program allows.

Web Any one person can give a gift of 15000 or less to another individual and not have to pay taxes on it. Web Gift funds can also be used to pay for closing costs which average between 2 and 6 of your loan amount depending on your loan amount. As of 2022 you could give up to 16000 to any one person without incurring the gift tax.

Luckily writing a gift letter. Web This 20 in gift equity would count as your down payment. If you have a credit score of 580 or.

Web For 2020 the IRS gift tax exclusion is 15000 per recipient. FHA mortgages are guaranteed by the Federal Housing Administration. Web The average rate for a 15-year fixed mortgage is 630 which is an increase of 12 basis points from the same time last week.

Web Most home buyers interested in using an FHA loan come up with at least 35 down from their own funds. Though the program does allow for 100 of that down payment to come in gift form -- as long as that money does not come from the seller a real estate agent or broker. One of the biggest advantages of receiving down payment gift money is that youll be able to put down a larger amount than you would have without it.

100 of the down payment can come from gift funds. However there are ways to get around. But the truth is different types of loans may each have their own set of requirements for a down payment and the.

Web For 2021 for instance parents who are married and who file a joint return can gift up to 32000 per child for a mortgage down payment or any other purpose without incurring a gift tax as of the tax year 2022. This is up from 30000 in 2021. The final sale paperwork would say that the home sold for 100000 but only 80000 would be required to pass from the buyer to the seller.

The down payment amount for an FHA loan can be as little as 35. This could mean buying a more expensive home or reducing the total amount youre financing. Web Good news.

The IRS does assess a gift taxon monetary gifts that exceed the annual exclusion which for 2021 is 15000. Web The rules for down payments on second homes are the same as the rules for your primary residence. Web In 2019 32 of first-time homebuyers received a gift or loan from a relative or friend toward their down payment according to a 2020 report from the National Association of Realtors.

27 Financing a Home 13 Research 33 Selling a Home 3 Posts By Month. Anytime you gift more than 15000 for. Web Step 1.

Your choice of down payment can. Some programs even allow you to use gift money to meet mortgage reserve requirements which are funds set aside to cover several months worth of monthly payments. Web For FHA loans.

Web Advantages of using gift money for your down payment. Web According to the 2019 Profile of Home Buyers and Sellers by the National Association of Realtors the median down payment for homebuyers is 12 of the purchase price which would be 24000 for a 200000 home for example. If your credit is between 580-619 at least 35 of your down payment has to be of your own money.

Web Tax Implications for the Giver of a Down Payment Gift The IRS imposes a gift tax on certain monetary gifts and this tax is paid by the person donating the money rather than the one who receives it. If your child purchases a home with a spouse or fiancé you and your spouse could each gift up to 15000 to the buyers for a total of 60000. Keep in mind that the home would.

Web A down payment is money you pay to make up the difference between the price of the home and the amount of the mortgage. Write the down payment gift letter The gift letter is key to getting your mortgage approved when using a cash gift for your down payment. Web According to the IRS gift tax exclusions in 2022 any down payment gift below 16000 does not have to be reported.

For tax year 2022 you and a spouse can each gift your child up to. As the borrowergiftee you probably wont be on the hook for any taxes on the down payment gift you receive. Web Under the Internal Revenue Services annual gift tax exclusion one person can give up to 14000 to another person in 2013 without triggering a gift tax.

That means that you and your spouse can each gift up to 15000 to anyone including adult children with no gift tax implications.

Fha Gift Funds Guidelines 2023 Fha Lenders

Fha Loan Complete Guide On Fha Loan With Its Working And Types

Gift Card Examples

No Savings Living Paycheck To Paycheck Importance Of An Emergency Fund

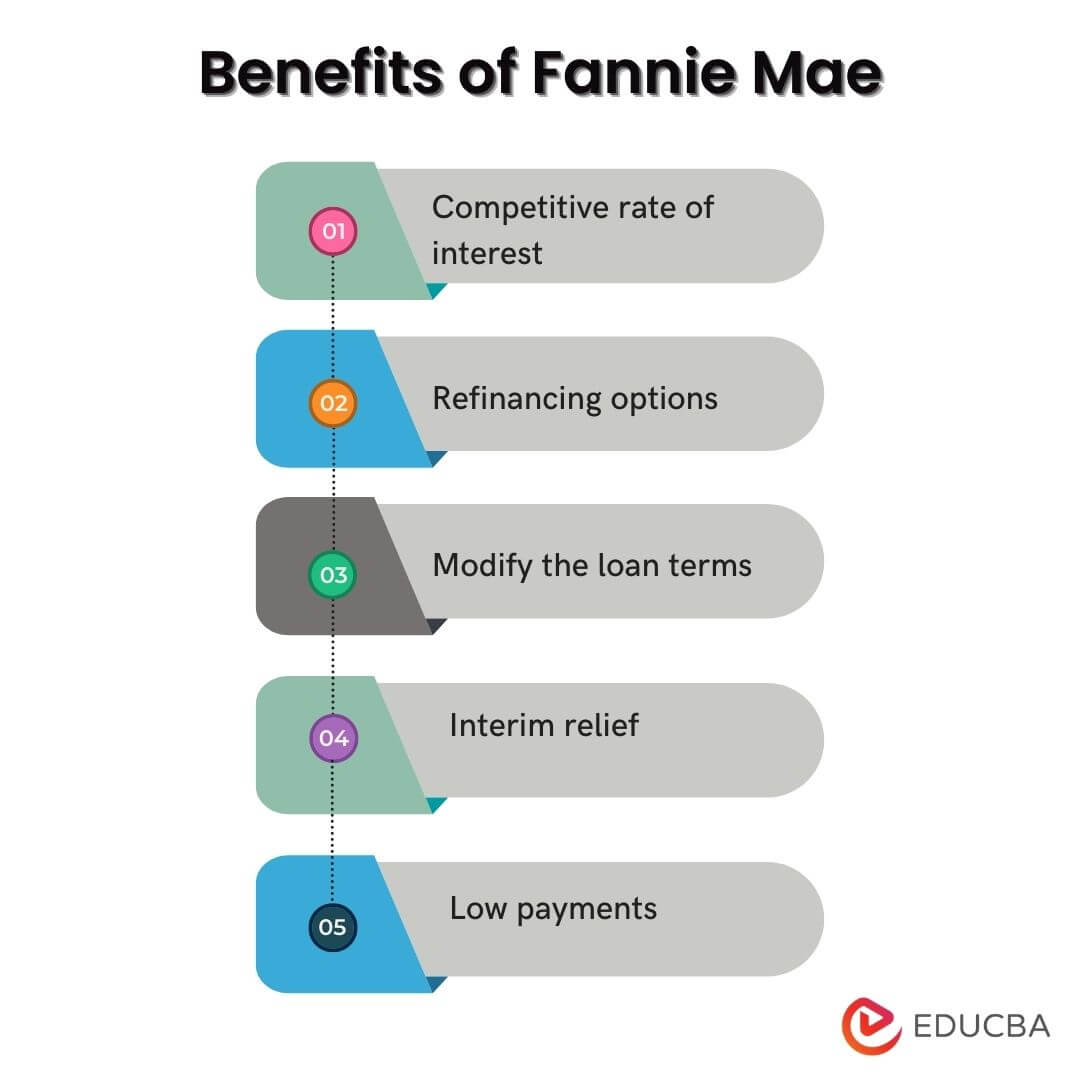

What Is Fannie Mae Purpose Eligibility Limits Programs

Online Banking Michigan Credit Union Online Banking Msgcu

How To Write A Gift Letter For Your Mortgage Down Payment

Rgv New Homes Guide Issue 30 Vol 4 November December 2022 January 2023 By New Homes South Texas Issuu

Using Gift Funds For Down Payment What To Know

How To Write A Mortgage Gift Letter For Your Down Payment

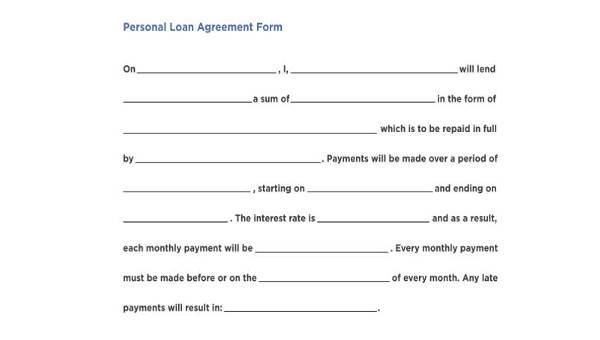

Free 8 Personal Loan Agreement Forms In Pdf Ms Word

How To Write A Mortgage Gift Letter For Your Down Payment

Down Payment Gift Letter Definition Rules Template

Down Payment Gift What You Should Know Mortgagehippo

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgages Using Gift Money For A Down Payment In Kentucky For A Mortgage Loan

Soi Building A Real Estate Agent S Sphere Of Influence Icenhower Brian 9781981953721 Amazon Com Books

Gift Money For Down Payment Gift Letter Form Download