15+ paycheck calculator ri

Rhode Island Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local. Rhode Island Salary Paycheck Calculator Change state Calculate your Rhode Island net pay or take home pay by entering your per-period or annual salary along with the pertinent federal.

October 2010 The Rhode Island Saltwater Anglers Association

Rhode Island Income Tax Calculator 2021.

. 51 Arm Mortgage Rates. We designed a handy payroll calculator to ease your payroll tax burden. Supports hourly salary income and multiple pay frequencies.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. If you make 70000 a year living in the region of Rhode Island USA you will be taxed 11081.

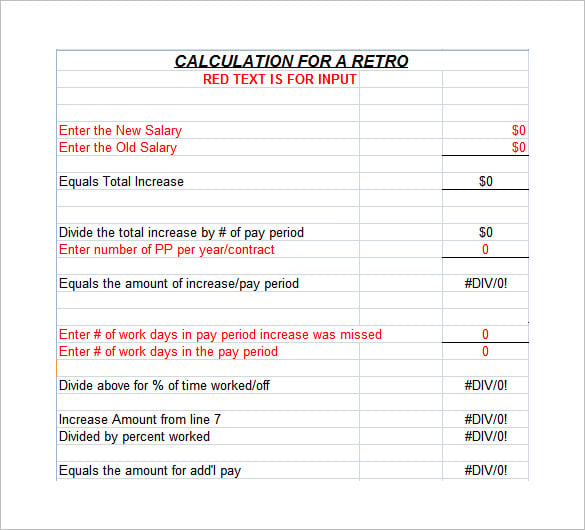

Simply enter their federal and state W-4 information. Calculate your payroll tax liability Net income Payroll tax rate Payroll tax liability minus any tax liability deductions withholdings Net income Income tax liability. Enter your employment income into the paycheck calculator above to find out how taxes in Rhode Island USA affect your finances.

Overview of Rhode Island Taxes. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Rhode Island. 71 Arm Mortgage Rates.

Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. The tax rates vary by income level but are the same for all taxpayers. Well do the math for youall you need to do is.

Youll then get your estimated take home pay a detailed. Payroll Tax Salary Paycheck Calculator Rhode Island Paycheck Calculator Use ADPs Rhode Island Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Rhode Island.

Your average tax rate is 1198 and your. Rhode Island has a progressive state income tax system with three tax brackets. For example if an employee earns 1500 per week the individuals annual.

All you need to do is enter wages earned and W-4 allowances for each of your employees.

Rhode Island Salary Paycheck Calculator Gusto

What Is The Take Home Pay For 130 000 Dollars Quora

Pumpkin Baby Shower Twins Invitation Digital File Twin Etsy

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Va Funding Fee How Much You Ll Pay Quicken Loans

Rhode Island Income Tax Calculator Smartasset

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

System Administrator Salary How Much Can You Earn

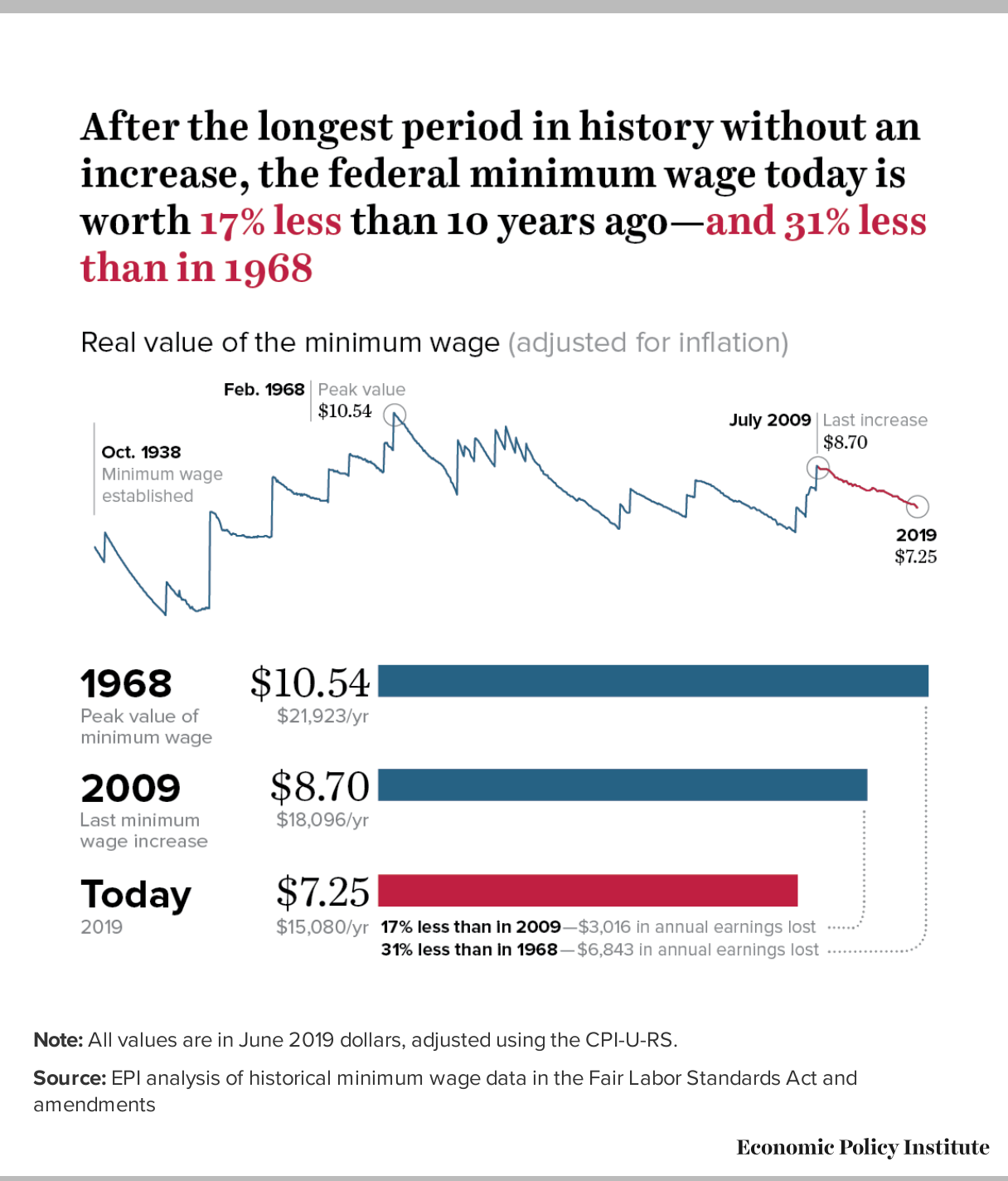

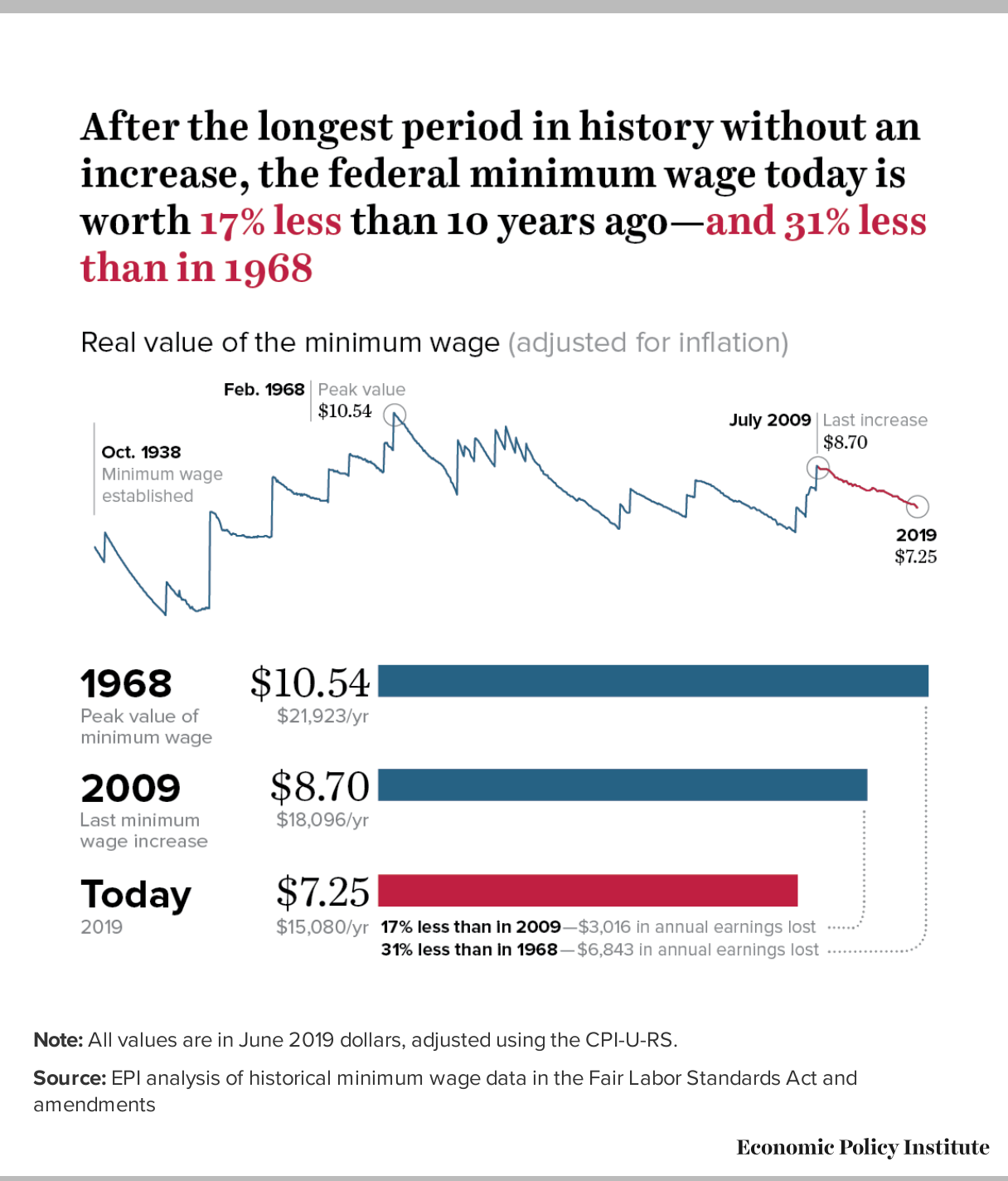

Labor Day 2019 Low Wage Workers Are Suffering From A Decline In The Real Value Of The Federal Minimum Wage Economic Policy Institute

Email Footer Design Best Practices Examples To Spice It Up

Seer Savings Calculator 13 Vs 14 Vs 15 Vs 16 Vs 18 Seer

Payroll Senior Resume Samples Velvet Jobs

Paycheck Calculator Us Apps On Google Play

Us Paycheck Calculator Queryaide

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

:max_bytes(150000):strip_icc()/regression-4190330-FINAL-5aa2077b47a64bbe91b64e6715ea836b.png)

What Is Regression Definition Calculation And Example

Elive Auction 12 By Kunker By Fritz Rudolf Kuenker Gmbh Co Kg Issuu